update on mn unemployment tax refund

-In addition to your tax the following assessments will be included in your balance due. Click on Tax Tools on the left side of the screen.

Minnesota Lawmakers Finish Deal On Unemployment Bonuses Www Wdio Com

21221and received my federal return 3121.

. Additional Assessment for 2022 from 1400 to 000. Weve finished adjusting 2020 Minnesota tax returns affected only by law changes to the treatment of Unemployment Insurance UI compensation and Paycheck Protection Program PPP loan forgiveness. There is no need for taxpayers to file an amended return unless the calculations make.

Minnesota Unemployment Refund Update. We know these refunds are important to those taxpayers who have. Update Unemployment Exclusion.

The Internal Revenue Service has announced that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. R object Object icon rtaxrefundhelp Okay so. I received my 2022 Unemployment Insurance Tax Rate Determination form from the State of Minnesota.

-2022 tax rate is 050. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. MINNEAPOLIS WCCO The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds that have been delayed due to tax law changes.

Unemployment EIDL PPP Loan Forgiveness and More. My adjusted Gross Income was 4128300 my Minnesota taxable Income was 364800 and my Refund amount was 44800. Thats the same data.

The Minnesota State Capitol in Saint Paul Minnesota. Stimulus Unemployment PPP SBA. Unemployment tax refund update.

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. Minnesotas Tax Bill Update.

The IRS will continue reviewing and adjusting tax returns in this category this summer. In the latest batch of refunds announced in November however the average was 1189. Now after the Federal and State updates my State AGI is 3378200 My MN taxable Income is 1002400 and my refund amount is 10500.

This is the fourth round of refunds related to the unemployment compensation exclusion provision. The exclusion is reported on Schedule 1 Line 8 as a negative number. I still do not have any update on my transcript whatsoever in the transactions section where they tell you to look for a later date.

Call the automated phone system. The Minnesota Department of Revenue. Irs schedule for unemployment tax refunds with the latest batch of payments on nov.

On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill. The unemployment compensation exclusion was updated across all TurboTax platforms online and desktop on 03262021. --Federal Loan Interest Assessment.

Adjusted about 540000 Individual Income Tax returns and issued refunds to taxpayers affected only by the UI and PPP changes. Base Tax Rate for 2022 from 050 to 010. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said.

September 15 2021 by Sara Beavers. After several waves of unemployment taxes refund todays update will explore the new upcoming wave of tax returns the irs new update message an expected letter and potential groups expected to receive their 10200 unemployment tax break taxes return for. September 13th 2021.

The unemployment compensation received is on Line 7 of Schedule 1. View step-by-step instructions for accessing your 1099-G by phone. As of January 27 2022 we have.

President Joe Biden signed the pandemic relief law in March. Here are my Minnesota numbers prior to the Federal Unemployment exclusion. The tax cuts for workers who received unemployment compensation and the tax cuts for small businesses in the bill were really important because so many people were so impacted by COVID-19.

Earlier this month Minnesota tax code changes were signed into law with a focus on unemployment compensation Paycheck Protection Program PPP loan forgiveness and other retroactive provisions affecting tax years 2018 through 2020. On Thursday September 9 th the Minnesota Department of Revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of September 13 th. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022.

I filed HOH 1 dependent. The new law reduces the. If you received unemployment benefits in Minnesota before 2021 you can also view your previous 1099-G forms.

We know these refunds are important to. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. The result flows to Form 1040 Line 8.

51022 at 1230 pm. The Center Square The Minnesota Department of Revenue will start sending out more than 540000 tax returns impacted by tax law changes to Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness. State officials say refund checks should start going out this week to roughly half-a-million Minnesota taxpayers who filed returns before the legislature passed a law affecting COVID unemployment insurance benefits and businesses Paycheck Protection Program payments making them exempt from Minnesota income tax.

The IRS has identified 16.

Ppp Ui Tax Refunds Start In Minnesota

I Owe Minnesota Unemployment Compensation For An Overpayment Can Bankruptcy Help Walker Walker Law Offices Pllc

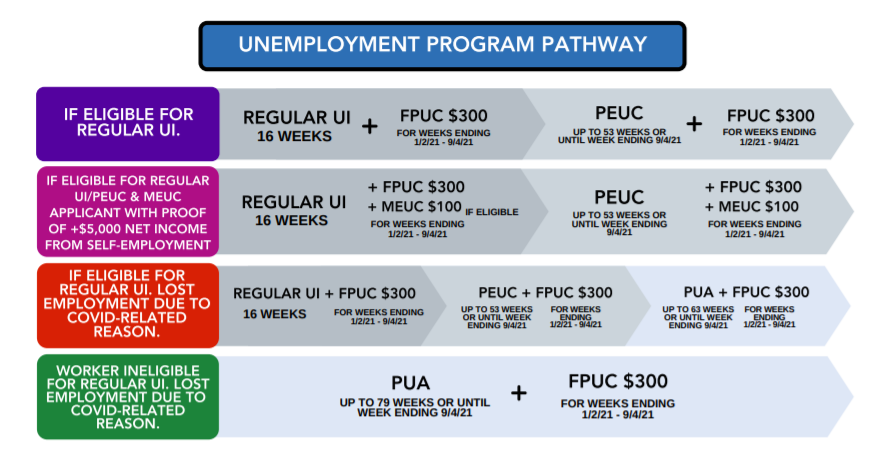

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota

Minnesota House Oks Unemployment Insurance Bill With Frontline Worker Bonuses Wcco Cbs Minnesota

House Dfl Proposes Fifth Tier Income Tax For High Earners Some Relief For Ppp Loans And Jobless Benefits Wcco Cbs Minnesota

House Oks Unemployment Insurance Bill Kare11 Com

667k Minnesotans To Get Pandemic Hero Pay Business Unemployment Tax Increase Reversed Twin Cities

Mn Legislature Yet To Reach Deal On Unemployment Insurance Bring Me The News

Official Website Applicants Unemployment Insurance Minnesota

Walz Criticizes Lawmakers For Failing To Reach Deal On Unemployment Insurance Tax Fix Twin Cities

Dfl Gop Come To Agreement On Unemployment Insurance Frontline Worker Bonuses Bring Me The News

Income Tax Subtraction For Unemployment Benefits New Legislation Would Bring It Back Session Daily Minnesota House Of Representatives

Walz Blasts Lawmakers Over Unemployment Insurance Dispute Wcco Cbs Minnesota

Unemployment Tax Break Update Irs Issuing Refunds This Week Kare11 Com

Parental Income Influences Child Support Payments Pin This List As A Reference For What Sources Coun Child Support Quotes Child Support Payments Child Support

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned