closed end credit def

The borrower must completely satisfy the terms of the loan in that period of time. Full payment includes amount advanced interest and.

All are closed-end meaning the number of investors and amount.

. Exploring the Basics of Closed-End Loans. Close-End Credit A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC.

Procurement of a closed-end credit is a good indicator of the borrowers. Closed end credit is a type of loan which entails a fixed amount of funds sometimes for a specific purpose. English English closed-drainage area closed-eave roof closed-end closed-end arbitrage closed-end company closed-end credit.

Related to Closedend credit. Closed-end credit is a type of loan or credit agreement signed between a lender and a borrower that includes details about the stipulated amount borrowed interest rates and charges applicable and monthly installments payable depending on the borrowers credit rating. Closed-end credits include all.

For instance if you take out a car loan or a real estate loan youll be given a set amount of money with a particular repayment schedule. Closed-end credits include all. For example in an automotive loan the lender might extend credit for five years.

The borrower must completely satisfy the terms of the loan in that period of time. Browse the use examples closed-end credit in the great English corpus. Used to describe an investment fund in which shares in the fund can be bought and sold but no new.

A closed-end loan allows individuals to access a fixed sum of money that can be used to finance the purchase of a major asset such as a home or vehicle. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. Closed-end credit means a credit transaction that does not meet the definition of open-end credit.

Learn the definition of closed-end credit. The principal and interest of the loan must be paid completely in the timeline established by the lender. Close-end credit An agreement in which advanced credit plus any finance charges are expected to be repaid in full over a definite time.

Check out the pronunciation synonyms and grammar. For example in an automotive loan the lender might extend credit for five years. At its most fundamental level a CEF is an investment structure not an asset class organized under the regulations of the Investment Company Act of 1940.

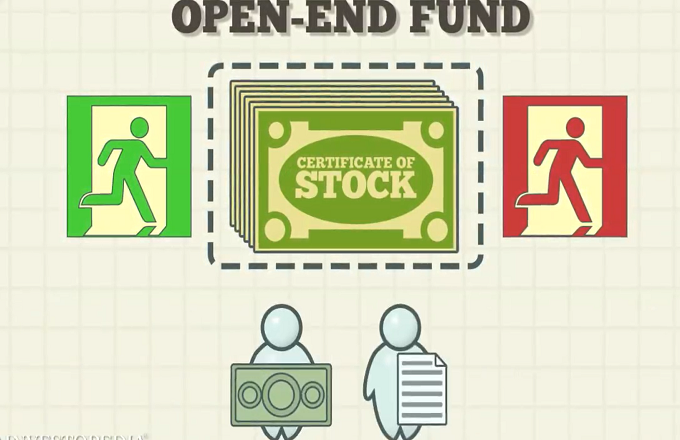

Closed-End Credit Law and Legal Definition A credit arrangement to be paid in full by a specified date is closed end credit. A closed-end fund is not a traditional mutual fund that is closed to new investors. Adjective having a fixed capitalization of shares that are traded on the market at prices determined by the operation of the law of supply and demand compare open-end.

This loan must be paid including interest and financial charges within a stipulated period. Open-end credit means credit extended by a creditor under an agreement in which. Like a mutual fund a closed-end fund is a pooled.

A CEF is a type of investment company whose shares are traded on the open market like a stock or an ETF. Glosbe uses cookies to ensure you get the best experience. The repayment includes all the interests and financial charges agreed at the signing of the credit agreement.

If the borrower does negotiate a modification of the loan the borrower will be subject to penalties as determined by the lender. In contrast a closed-end credit is when one requests a lender to borrow a specific amount of money usually in a lump sum and paid up front and then one is required to repay the principal and interest according to a regular payment schedule set by the lender. Closed-end credit is a type of credit that should be repaid in full amount by the end of the term by a specified date.

Close-End Credit A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date. Most real estate and automobile loans are closed-end. In closed-end credit facility credit proceeds must be paid in full on closing credit arrangement.

BANKING AND CREDIT NEWS-March 18 2019-Duff Phelps declares. Means a credit transaction that does not meet the definition of open-end credit. There is often confusion between an open-end credit and a closed one.

Closed-end credit is a type of credit that should be repaid in full amount by the end of the term by a specified date. Specifically the borrower cannot change the number or amount of installments the maturity date and the credit terms. Closed End Credit is defined 2262 as credit other than open-end credit.

Truth In Lending Act Tila Consumer Rights Protections

Revolving Credit Vs Line Of Credit What S The Difference

/78293570-5bfc2b8cc9e77c0026b4f8e9.jpg)

Credit Default Swap Cds Definition

The Batman Has An End Credit Scene And Here S Its Hidden Meaning

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

Revolving Credit Vs Line Of Credit What S The Difference

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Understanding Different Types Of Credit Nextadvisor With Time

/close-up-of-credit-cards-580502979-3998b1e8a9d242c98648cc04ce236e8b.jpg)

Line Of Credit Loc Definition Types And Examples

Line Of Credit Loc Definition Types And Examples

Month End Close Process How To Make Accounting More Efficient

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Netting_Oct_2020-01-b5e667983a3b4fbda61e968ac11d96bc.jpg)

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)

:max_bytes(150000):strip_icc()/155571944-5bfc2b9646e0fb005144dd3f.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/GettyImages-172204552-a982befe78f94122afee99916a7a4704.jpg)

:max_bytes(150000):strip_icc()/GettyImages-531408152-8ff55e27227d4404849017d66759789c.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)