defer capital gains taxes indefinitely

The IRS divides its capital gains tax methods between short-term less than a year and long-term one year or longer. These capital gains defer taxation until the end of 2026 or whenever the asset is disposed of whichever is first.

Commentary How Californians Can Utilize Dsts To Avoid Capital Gains Tax And Diversify Their Portfolios California Business Journal

A Brief History of the Capital Gains Tax in Canada.

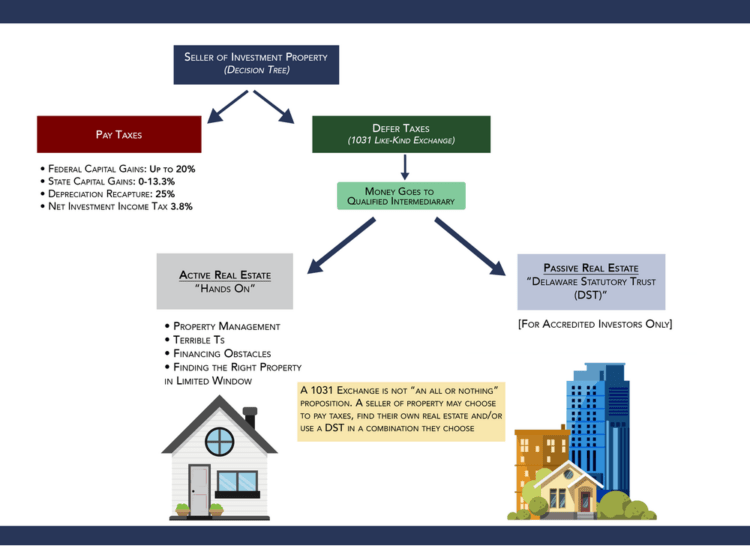

. Understanding capital gains tax is critical when dealing with appreciated assets. The DST defers capital gains and other taxation on the sale. Those willing to reinvest and buy more property can defer the capital gains tax with a 1031 exchange.

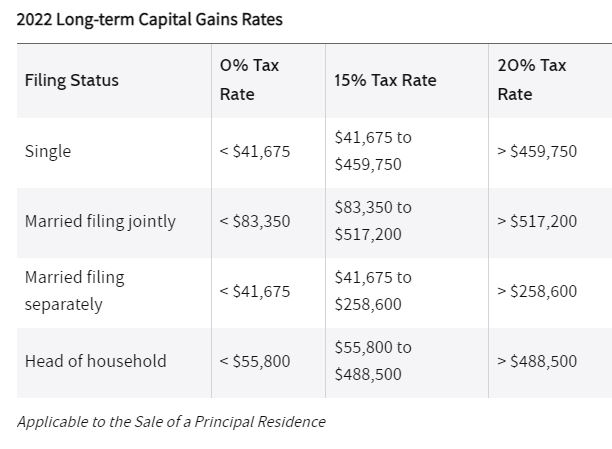

In the event that you sell anything for more than what you bought it for you will need to report this capital gain to the IRS. The DST bridges the gap between selling the property and sheltering the capital gains from it. For people in the 10 or 12 income tax bracket the long-term capital gains rate.

If the gain is. 1972 - it started with a 50 Inclusion Rate and all prior. You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS.

Use Capital losses to. Defer capital gains by investing in EIS. The 10 12 Tax Bracket.

Not only can you delay paying taxes on capital gains depending on how long your gain has been held in the fund your basis can increase by up to 15. A Section 1031 exchange can help you defer capital gains tax on appreciated property indefinitely and possibly eliminate it permanently. To encourage investment in these areas the IRS has created a program that allows investors to defer a certain amount of their capital gains taxes upon sale.

3 ways to defer capital gains tax that could turn you a profit. Second capital gains placed in Opportunity Funds for a minimum of five. How to Reduce or Avoid Capital Gains Taxes Turn Your Investment Property into Your Primary Residence.

Keep in mind that the IRS does consider virtually anything that you own to be a capital asset including personal items. If you sell your Acme Building stock within six months the IRS will tax. There is a way to accomplish the sale of an asset you own that has grown in value so that you not only defer your capital gains tax for many years but you also exit with cash equivalent to most of the sales proceeds.

There is also 30 Income Tax relief on the investment. The Deferred Sales Trust. The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier.

Ending Post-Liquidation Wealth for 1 Deferring Gains until the End of Investment Horizon and 2 Crystallizing Gains Today Starting from an Investment with Hypothetical 1. Investing a taxable gain in an EIS allows you to defer capital gains for as. You can defer tax on capital gains until after December 31 2026.

January 1 2022 is the 50th anniversary of the capital gains tax. Many clients choose to indefinitely defer their capital gains taxes by investing the entire principle. The easiest way to limit or avoid the capital gains tax is to.

6 Ways To Defer Or Pay No Capital Gains Tax On Your Stock Sales 1. In fact you can walk away with an amount equal to 935 of your net sales proceeds tax deferred. What is a 1031 Exchange.

In practice you can defer paying capital gains tax on this money indefinitely if you continue to reinvest it in an EIS each time you dispose of your shares providing you have. As the investment is an untaxed gain the. In turn the IRS will levy taxes against the gains.

There is a permanent exclusion of tax on the appreciation of the investment in the opportunity zone if it is. This allows them to receive monthly payments for the interest accrued on their investments. DSTs are eligible for the same tax benefits as 1031 exchanges which means investors can use DSTs as a vehicle for deferring capital gains tax sometimes indefinitely.

Those not willing to keep investing in property ready to cash out in other. Furthermore if you keep.

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Deferred Sales Trust 101 A Complete 2021 Guide Tdr Real Estate Group Hill Country Ranch Sales

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Swap Tactic Lets You Defer Capital Gains Tax Perpetual Cpa

High Class Problem Large Realized Capital Gains Montag Wealth

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Income Tax Deferral Strategies For Real Estate Investors

High Class Problem Large Realized Capital Gains Montag Wealth

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Capital Gains Tax In The United States Wikiwand

High Class Problem Large Realized Capital Gains Montag Wealth

Capital Gains Tax Canada Explained What It Is How It Works

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Minimizing The Capital Gains Tax On Home Sale Bubbleinfo Com

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)