nebraska sales tax rate 2020

We provide sales tax rate databases for businesses who. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

Free Unlimited Searches Try Now.

. If it is listed as part of the rental price then it is subject to Nebraskas sales tax rate. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75.

The Nebraska sales tax rate is 55 as of 2022 with some cities and counties adding a local sales tax on top of the NE state sales tax. 536 rows Nebraska Sales Tax55. The Ord Sales Tax.

Related

- latin grocery near me

- white wingback chairs dining

- sac bee government salaries

- all seasons body work upper west side

- amazon new jersey hiring

- how to get physical starbucks gold card

- burger king happy meal toys september 2020

- liberty auto sales lincoln ne

- toyota sales event near me

- precision auto sales cedar creek tx

The minimum combined 2022 sales tax rate for Nebraska City Nebraska is. Local Sales and Use Tax Rates Effective January 1 2020 Dakota County and Gage County each impose a tax rate of 05. Tax Rate Starting Price.

The base state sales tax rate in Nebraska is 55. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. The Nebraska state sales and use tax rate is 55 055.

The minimum combined 2022 sales tax rate for Nemaha Nebraska is. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from. Waste Reduction and Recycling Fee.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates.

This is the total of state county and city sales tax rates. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. The state sales tax rate in Nebraska is 5500.

So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022. Exemptions to the Nebraska sales tax will vary by state.

Wilcox Hildreth Bloomington Riverton Naponee and Upland. FilePay Your Return. What is the sales tax rate in Omaha Nebraska.

Ad Get Nebraska Tax Rate By Zip. With local taxes the total sales tax rate is between 5500 and 8000. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

Changes in Local Sales and Use Tax Rates Effective April 1 2020. This is the total of state county and city sales tax rates. Raised from 55 to 65.

Sales Tax Rate Finder. Find your Nebraska combined state. The Nebraska state sales and use tax rate is 55 055.

The Ord Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Ord local sales taxesThe local sales tax consists of a 150 city sales tax. While many other states allow counties and other localities to collect a local option sales tax. Simplify Nebraska sales tax compliance.

30 rows Nebraska NE Sales Tax Rates by City. The Nebraska NE state sales tax rate is currently 55. See the County Sales and Use Tax Rates section.

The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. Sales and Use Taxes. Average Sales Tax With Local.

Sales Tax Rate s c l sr. If the business were to charge 10575 for the. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up.

Thus the total sale would be 11125 in this example. What is the sales tax rate in Nebraska City Nebraska.

States With Highest And Lowest Sales Tax Rates

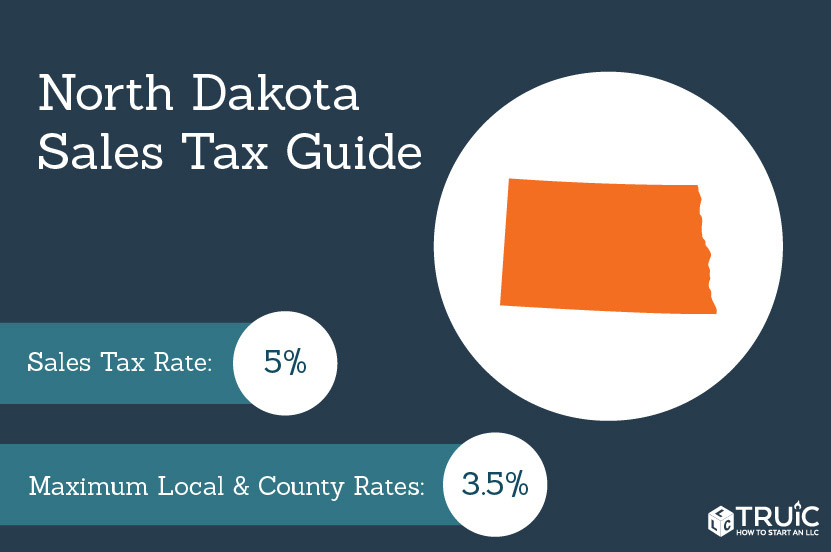

North Dakota Sales Tax Small Business Guide Truic

How Is Tax Liability Calculated Common Tax Questions Answered

Don T Die In Nebraska How The County Inheritance Tax Works

State Corporate Income Tax Rates And Brackets Tax Foundation

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Sales Tax On Grocery Items Taxjar

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Michigan Income Tax Rate And Brackets 2019

State Income Tax Rates Highest Lowest 2021 Changes

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Sales Taxes In The United States Wikiwand

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation