summit county utah sales tax

The current total local sales tax rate in Summit UT is 6100. 6 rows The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and.

Utah State Hospital Wikipedia The Free Encyclopedia Abandoned Asylums Utah Hospital

67 of the Utah Code Annotated and forwarded to the Utah State Treasurer after one year has elapsed from the date of the tax sale.

. Average Sales Tax With Local. The committee is governed by the enabling. The average cumulative sales tax rate between all of them is 778.

Check payments are processed by our banks facility in Seattle but all tax funds are managed by our local office in Coalville Utah PAY IN PERSON. The most populous location. Summit County collects the highest property tax in Utah levying an average of 192100 039 of median home value yearly in property taxes while Rich County has the lowest property tax in the state collecting an average tax of 42200 035 of median home value per year.

Publication 56 Utah Sales Tax Info for Lodging Providers. You may register as a bidder for the tax sale by visiting this link. Has impacted many state nexus laws and sales tax collection requirements.

For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. Access Utah sales and use tax rates on the Utah State Tax Commissions website. 8 rows The Summit County Sales Tax is 155.

The latest sales tax rate for Summit Park UT. Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84134 taxmasterutahgov 801-297-7705 1-800-662-4335 ext. The primary purpose of the Restaurant Tax Grant is to promote tourism as set out by the Utah State Statute and the County Council.

The Utah state sales tax rate is currently 485. Automating sales tax compliance can help your business keep compliant with. Summit County residents first approved.

Deadline for 2022 Tax Relief Applications. This rate includes any state county city and local sales taxes. The 2022 Summit County Tax Sale will be held online.

Summit County Home Page. State Local Option. Summit UT Sales Tax Rate.

Summit County Treasurer Lockbox 413118 PO Box 35147 Seattle WA 98124-5147 Yes Seattle is correct. The Treasurer is responsible for the banking reconciliation management and investment of all Summit County funds. You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables.

Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor. Cash management and investment duties are performed in. The December 2020 total local sales tax rate was also 6100.

Bids Request for Proposals. Complete the online building application. Tax rates are provided by Avalara and updated monthly.

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06. The funding is generated via a 010 sales tax on certain goods and was created to support the funding of local arts and recreation organizations.

This page lists the various sales use tax rates effective throughout Utah. The 2018 United States Supreme Court decision in South Dakota v. Important Property Tax Dates.

3 rows Summit County UT Sales Tax Rate The current total local sales tax rate in Summit County. Report and pay this tax using form TC-62F Restaurant Tax Return. Summit County Utah Recorder-4353363238 Assessor-4353363211.

2022 Property Tax Due Date. 2020 rates included for use while preparing your income tax deduction. To review the rules in Utah visit our state-by-state guide.

Manage Summit County Funds. Select the Utah city from the list of popular cities below to see its current sales tax rate. A county-wide sales tax rate of 155 is.

Utah has recent rate changes Thu Jul 01 2021. Look up 2022 sales tax rates for Summit Utah and surrounding areas. Utah has state sales.

Mycashutahgov for more information. The state sales tax rate in Utah is 4850. Access county bids and request for proposals.

All Tax Commission Publications. The Summit County sales tax rate is 155. Beer Alcohol Licensing.

To compare Summit County with property tax rates in other states see our map of property taxes. Additional Information Contact the Tax Commission with questions at. With local taxes the total sales tax rate is between 6100 and 9050.

SUMMIT COUNTY Utah The Summit County Council approved the 2022 recreation arts and parks RAP tax grant recommendations at their meeting on Wednesday. The restaurant tax applies to all food sales both prepared food and grocery food. Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2108 on top of the state tax.

Publication 25 Sales and Use Tax General Information. See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax. The Summit County Council established the Restaurant Tax Advisory Committee to investigate advise and recommend the best uses of the funds collected from this tax.

Happy July 4th Video Independence Day Happy Independence Day Happy July

10 Most Expensive Homes For Sale In Utah Homie Blog Mansions Expensive Houses Luxury Swimming Pools

Corporate Retention Recruitment Business Utah Gov

News Flash Summit County Ut Civicengage

Utah Eviction Law Lease Termination Being A Landlord Lease Eviction Notice

News Flash Summit County Ut Civicengage

News Flash Summit County Ut Civicengage

Utah Sales Tax Rates By City County 2022

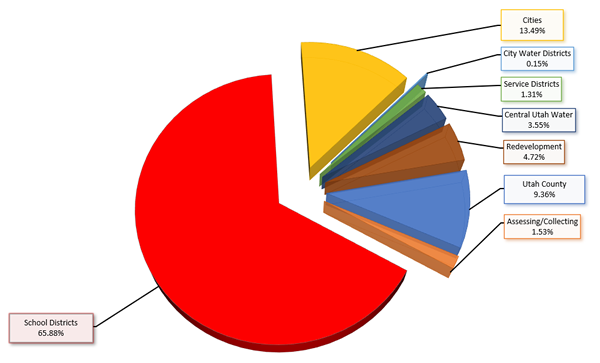

Taxing Entities Utah County Clerk Auditor

Patagonia Logo A Defiant Brand From Day One Patagonia Logo School Creative Patagonia